This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

I've always managed to straddle a myriad of typical lines between personalities and perspectives.

I played sports in high school, but I hate sports. I'm a white Mormon, but Mitt Romney is the only Republican I've ever voted for. I'm a venture capitalist who thinks rich people don't pay enough taxes. I'm a personal pacifist and non-gun owner that believes an effective military is one of the single greatest capabilities the US needs to possess.

But what that also means is that I'm sometimes caught off guard by the perspectives of a particular in-group. My shallow dabble across an eclectic collection of opinions and perspectives sometimes leaves me ignorant to what someone more defined by a particular thing would think is common sense.

Example.

I grew up listening to country music (and ska music cause my older brother was rebellious). But I pretended to like rap when I was in high school, cause that’s what everyone liked. In reality, the only rap I ever really liked was White & Nerdy by Weird Al. I could recite it right now and have you ROTFLOL.

I remember once in high school being at a WalMart flipping through the poster display case and I came across a collection of the greatest rappers. My friends started naming each of them, and I nodded as if I had any idea what they were talking about. To my ignorant mind, I saw a lot of black guys and one white guy. So I assumed the white guy must be the worst one in the group. 🤷♂️

Fast forward to a group of my friends all hanging out after we had just been to our high school's talent show where a young white fella had tried his hand at rapping. He was quite bad. Some of my friends were commenting on it, and I said, thinking it would be a relevant contextual joke, "he's just as bad as Eminem."

When I tell you the oxygen was sucked out of that room faster than a rocket exploding, I mean it. I can still palpably feel the embarrassment I experienced. I knew enough to know who Eminem was but not enough to know that he was considered one of the greatest rappers of all time.

In every in-group that I'm a part of, or even tangentially glance off of, there are these litmus tests. These unspoken perspectives that define where you fit in the group. And sometimes you can get caught off guard by where people fall along the spectrum of that perspective.

That happened to me this week when it came to the question of: "is venture capital an apprenticeship business?”

The Tweet Test

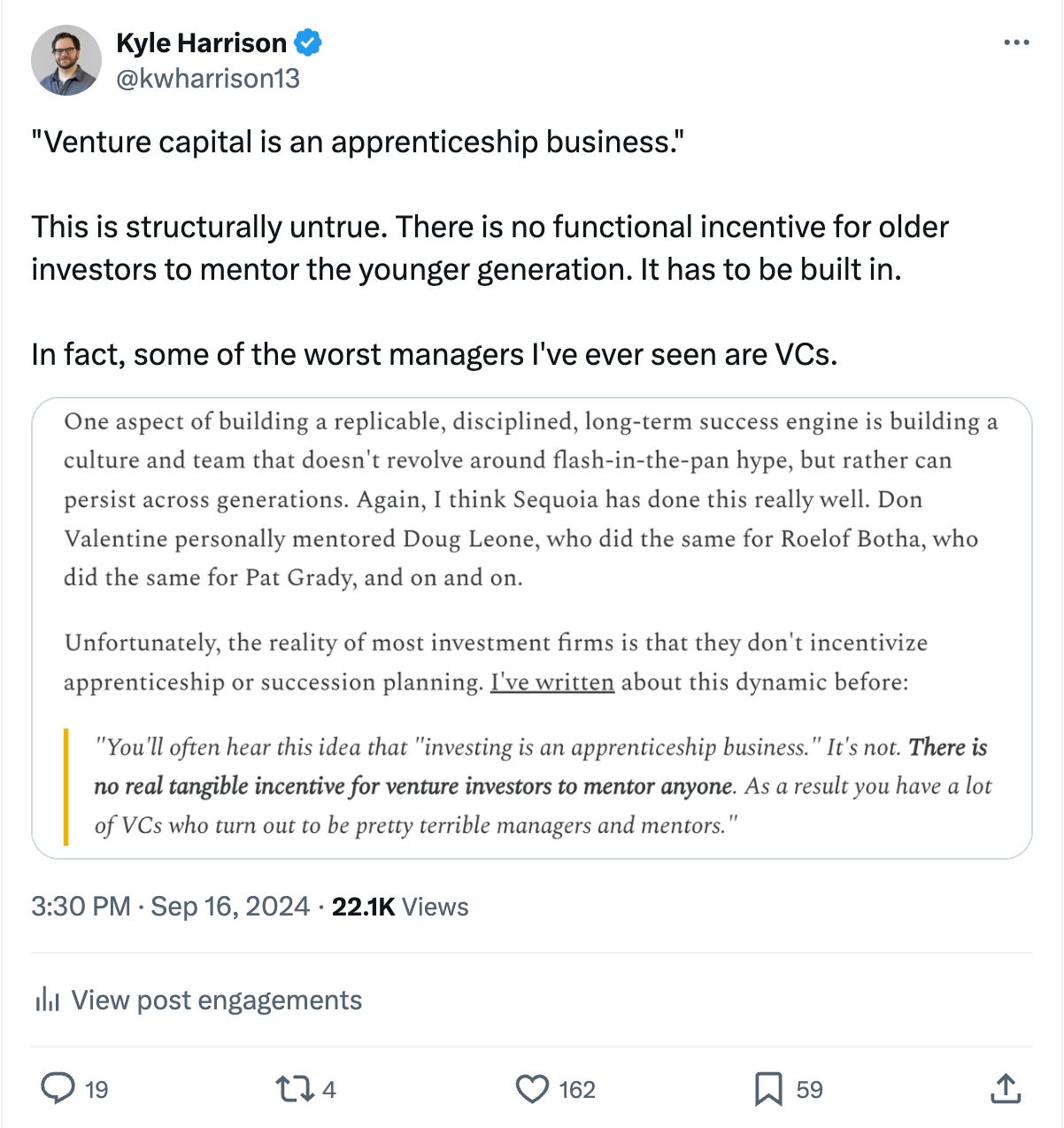

I've written several times before about the idea of apprenticeship in venture capital. Recently, I've been sharing some of my favorite nuggets from my past writing on Twitter, and one such nugget struck a chord this week:

The first thing that bothered people was that management vs. apprenticeships are very different. And I agree with that to a point. But most VCs being bad at people management is a canary in the coal mine.

Being bad at understanding where your people are, what they need to succeed, and working to create the environment they need for that success? If you're not good at that for a simple managerial relationship, how are you going to be good at it in a much more intense apprenticeship relationship?

A lot of people spoke up in defense of the idea that venture is, in fact, an apprenticeship business. But most often people defended that perspective by saying things like "here's how I've been able to apprentice myself to someone great," or "here's how I'm teaching people around me."

And its important to focus on the premise of my point. I didn't say apprenticeship in venture doesn't exist; it absolutely does. But there is no structural incentive from the get-go. "It has to be be built in." Let's look at the business of venture capital and try and find where apprenticeship pops up.

Business as Usual

I've written a bunch of times about the business model of venture capital. The reason why capital agglomerators exist is because they recognize the power of a more broadly diversified portfolio, more shots on a goal, and the firepower of having a war chest of management fees as you build an empire.

But at the end end of the day, Doug Leone said it best:

"The two most important things are (1) performance, and (2) teamwork. But if you don't have number 1 then nothing else matters."

At the end of the day, it all comes down to performance. If you make good investments, you succeed as a VC. If you make bad investments, you don't. And in that equation there is no incentive to apprentice anyone else. Some of the greatest investors have done very little imparting of wisdom. They just invest. Arthur Rock was literally the Godfather of venture capital. But Davis & Rock was nothing compared to Arthur just doing his own thing. Chris Sacca, with Lowercase, arguably just did his own thing, rather than a build an apprentice-heavy future-proofed firm.

The broader argument is about firm building. Building a good investment track record and building a good firm are very related but very different things. And firm building is where apprenticeship comes into play. If you want to build a firm that lasts beyond the success of an individual investor then you do, indeed, need to find ways to build up the rising generation.

The Boeing Example

Venture capital is an apprenticeship business the same way Boeing is an engineering business. Should it be? Yes. Does it say it is? Sure. But when you look at the scorecard, lately it’s mostly been a stock buyback business. “From 2014 to 2018, Boeing diverted 92% of its operating cash flow to dividends and share buy backs to benefit investors; far exceeding the money that it spent on R&D for new planes.” At its most abstract, maybe its a financial engineering business. But it hasn’t been an engineering business in a long time.

John Oliver did a great segment where he explored the history of Boeing, you can check that out for a more in-depth / punchy description. But the story is one I have kept coming back to in my mind, and its a doozy!

William Boeing, who founded Boeing in 1916, held a very high standard for his company, enforcing a culture that prized quality. “After noticing some shoddy workmanship on his production line [he said] that he would close up shop rather than send out work of this kind.”

But this long standing culture of excellence was watered down in August 1997 when Boeing merged with McDonnell Douglas. McDonnell Douglas was known for building military planes, but had a questionable reputation, at best, for commercial planes. Douglas launched a commercial airliner called the DC-10 in the 70s, for example, which over the course of its life resulted in 1.2K fatalities! Quartz later described the merger like this:

“In a clash of corporate cultures, where Boeing’s engineers and McDonnell Douglas’s bean-counters went head-to-head, the smaller company [meaning McDonnel Douglas] won out. The result was a move away from expensive, ground-breaking engineering and toward what some called a more cut-throat culture, devoted to keeping costs down and favoring upgrading older models at the expense of wholesale innovation.”

Building the best engineering organization became less important than the bottom line. Boeing’s culture, as a result, has suffered, leading to several whistleblowers coming forward about the quality of Boeing’s planes. In 2019, John Barnett, a former Boeing quality manager, claimed the company had ignored serious problems with substandard parts and oxygen system malfunctions. Barnett also claimed that, while he’d reported these failures, he’d been ignored.

In March 2024, while serving as a witness in the whistleblower case against Boeing, Barnett was found dead in his truck, supposedly due to self-inflicted wounds. Eerily, a friend of Barnett’s reported that days before, Barnett had told her that “if anything happens to me, it's not suicide." In May 2024, a second Boeing whistleblower suddenly died from unknown causes. Since these two deaths, over 40 other Boeing employees have come forward to try and enact change in the company’s safety procedures.

If Boeing’s decline from the high bar set by William Boeing’s production line to safety accusations and shady cover-ups is any indication, the business has long since moved away from being an engineering business. What it is now, I'm not sure. But it's not great.

The Venture Ideal

One of the times in the past I've written about apprenticeship in venture was in a piece I really enjoyed writing called Fantasy Capital where "I wanted play a game of ‘Fantasy Venture Capital’ based on the 'dream scenarios' that some people have for the funds they work with and for.”

In it, I talked about my ideal characteristics, like visionary leadership, a deliberate org-chart, a product-led value prop, built-in incentive for collaboration and apprenticeship, and intellectual honesty. The section I wrote about apprenticeship is still a pretty solid overview of what I see in the venture business:

In a venture firm internal political power comes from "getting deals done." When the main currency for the culture is getting credit for making investments it aligns every activity around deploying capital and judges it against that bar. That's one of the reasons other functional areas in a firm (talent, BD, content) are second-class citizens. If you can't directly correlate your contribution to "deals done" then your value is unclear. This would be like “closing a sale” being the only way anyone at a company can gain political power. Makes it real tough for engineering or marketing.

That "eat what you kill" lone-wolf culture exists in most venture funds. And its exacerbated by the emphasis most firms put on specific deal-makers. A lot of VCs would prefer to work in an effective team that can all trust each other and contribute to exceptional success.

But the sad reality of venture is that most investors struggle to trust each other. There is so much effort required to ensure you get credit for as much as possible that you always have to be hesitant of folks that might take any of your credit. I've written before about the struggle that venture firms face in trusting each other internally:

"No one trusts each other and you don't know how to sort through people. So you let these people prove themselves until you trust them. And you usually don't really trust them until you've already established your own career. Trust is a luxury."

This may seem like an exaggeration but deal-specific judgements are frequent in venture firms. A lot of investors have a story of when a senior partner came to them about a deal they weren't happy about doing to say something to the effect of, "If this deal doesn't work out? You're fired."

That's not apprenticeship or collaboration. That's a recipe to breed risk aversion, which is ironic for a group of people meant to be taking on risks. But risk-aversion is rampant not only in the way VCs think about investments but also about their own people internally. The way you build a killer organization is keep a high bar when recruiting and then establish resources to help make those people better.

Because of the focus on the "eat what you kill" metric there is very little time or energy devoted to actual apprenticeship in venture. When you're aligned around a shared vision you recognize the value in building people up to more effectively contribute to that vision.

Good Business

So. In general, venture capital is not an apprenticeship business because most VCs are neither incentivized nor good at taking on an apprentice. But, in the long run, apprenticeship in venture capital is good business. If you intend to build a firm that lasts beyond a particular investor or particular fund, you need to have an apprenticeship model.

A few weeks ago when I wrote my piece, Little Sister Syndrome, I had a whole section dedicated to "The Sequoia Engine." I think Sequoia is not only one of the best venture funds to ever exist, but they are also the most effective at apprenticeship. They've built a deliberate engine to enable the next generation because they're building an exceptional firm.

But the construct of venture capital doesn't automatically incentivize that. Making one good investment doesn't depend on the investor making the investment also making sure that the investor in question is teaching another investor what they're doing. They just have to make an investment.

The structural incentive behind apprenticeship in venture capital is, instead, built into the desire to not just make one good investment, but the desire to make one good investment engine. In other words?

"If you want to go fast, go alone; if you want to go far, go together."

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

Thank you Kyle for writing something I often think about - the need for good mentorship within and outside of investment firms - but cannot crystallize as well as you did!

My experience has been with the buy side investing (traditional stocks/binds/currencies markets) with mutual funds, institutional accounts and our own hedge fund companies. I am surprised to read about the trust problems in VC firms and sometimes the brutal-ness amongst colleagues, which I experienced in hedge fund companies, though not in ours. Our performance got validated everyday and even every minute because everything is marked to market - no one can hide behind performances.

So mentorship and teamwork under open leadership is a big and probably most essential thing in a successful investment firm even though we have too many star (and egoistic) managers who think they can do it alone and perform consistently (they confuse alpha with luck!) If all senior people in the industry understand the value of mentorship, the industry will be kinder, more productive, and truly build wealth for our customers!

Thanks for your writing!

Insightful, thanks for sharing this. Nice to read something thought provoking and which challenges current (default) views.