Investing 101

Revolution Through Evolution

This is a free weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

In this, the year of our Lord 2026, I mark my 12th year working in venture capital.

It’s my 5th year writing this blog every week without missing a week, bringing 25K subscribers now along for the ride across 208 posts and 500K+ words.

I’m going to be 34 years old, I’ve been married for 12 years, I have four kids (9, 6, 3, 1), I’ve started two companies, and sold one of them. Now that my wife and I are done having kids, and I just need to not suck at raising the ones I have, its left me also thinking through how to establish a life and routine that will be uninterrupted by another massive paradigm shift like adding another kid to the mix.

Contrary is my primary life’s work right now. I didn’t start the firm, but I joined four years in. This year marks my 5th year at the firm, and we’re currently investing out of our fifth fund. As part of the firm, I built Contrary Research; one of the largest private market research platforms in the world. We have 100K+ subscribers and have written 500+ reports across hundreds of companies and dozens of industry deep dives.

Investing. Family. Contrary. I’m in a position where a lot of my life is now in my control and at the mercy of my own systems and structure. Bill Gates once said “most people overestimate what they can do in one year and underestimate what they can do in ten years.” After I sold my first company, I had a hill I would walk down frequently. I called it my “10 Year Hill.”

I would stand at the top of it looking out and wondering where I would be in 10 years. Now, over a decade later, I’ve worked at four different investment firms, helped deploy billions of dollars into companies like Databricks, ServiceTitan, Figma, Robinhood, and a whole host of others. And I can tell you one thing; I didn’t see any of that when I stood at the top of my 10 Year Hill. Now, here I am, trying to build a new venture firm based on a decade of observing venture capital and how it’s evolving. And I find myself again wondering, what will the next decade hold?

The new year finds me reflecting on where each of these aspects of my life has placed me. Taking an inventory of that, I went through four key areas of my work: (1) Reading, (2) Research, (3) Writing, and (4) Investing. These four buckets feel like the compounding engine of my life for translating ideas into actions:

Reading broadly exposes me to ideas

Research allows me to dive deeper into the most compelling nuggets I uncover

Writing is how I determine what I think about what I’ve seen

Investing is how I convert intellectual discovery into belief-fueled action

What’s more, the process is cyclical. The most interesting ideas I want to read about come from the investments that I make. It pushes me to compound my perspective. New investments start the cycle all over again.

Reading

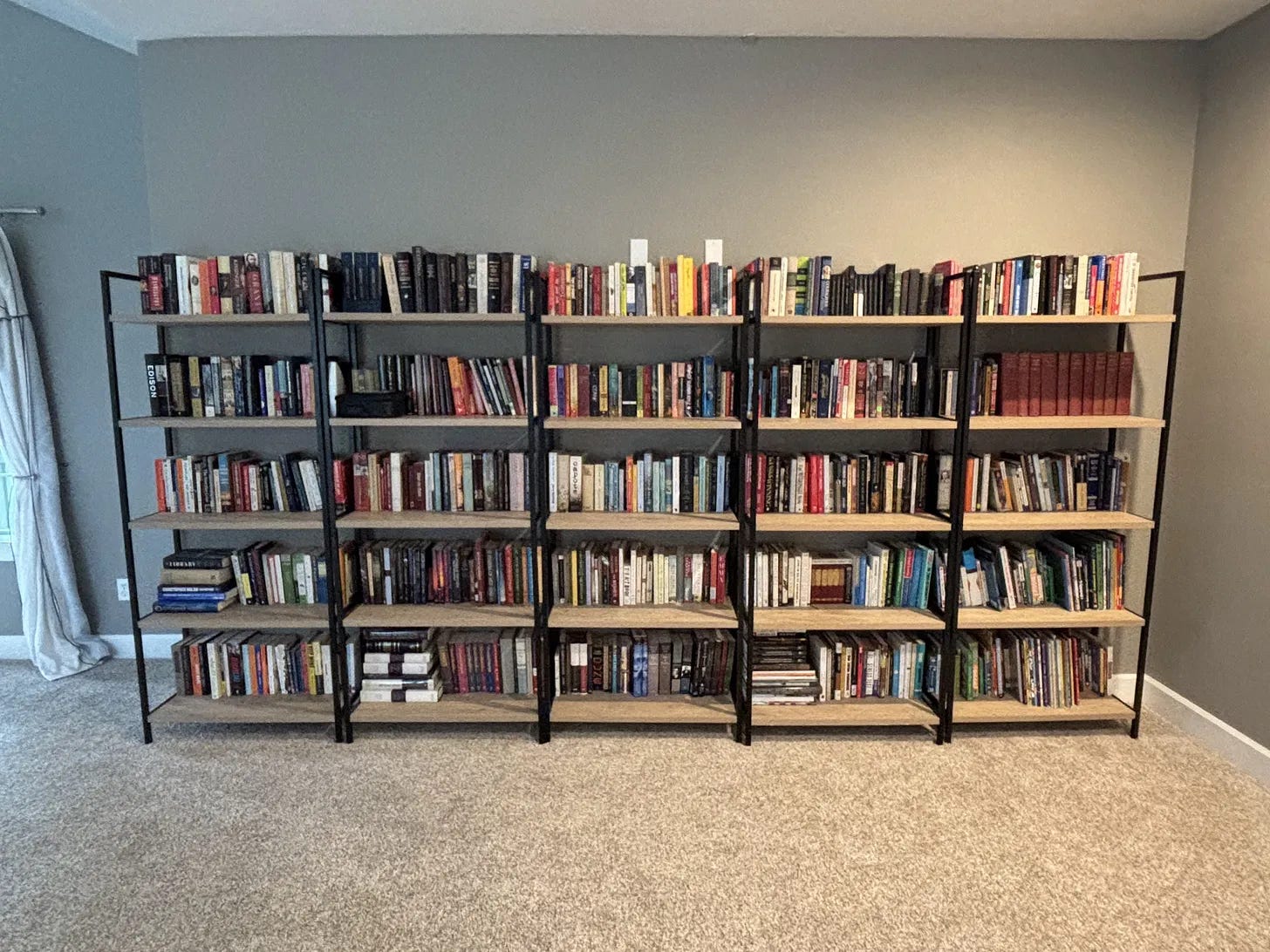

I’ve always had my books spread out across the house. But after a recent move, we’ve finally got them all (almost all) in one place. A little over 1K books. That, plus a massive list of books to read has me thinking harder about what I’ll read this year. In particular, this piece inspired me to read The Story of Civilization books by Will and Ariel Durant. Between long, dense history books, world-building science fiction audiobooks, books I can read on my Kindle app, and more... I’ve got a lot to read.

Rather than selecting ahead of time all the books I’ll read, instead I wanted to set a goal of how many pages to read each day. I did a similar exercise so I could finish The Book of Mormon in 6 months and it worked quite well.

So lets assume the average book is 350 pages long. I want to read ~40 books a year. That’s 14K pages. If I want to get there by the end of the year I need to read 38 pages a day; lets round up and say 40. Now, there are four categories that I want to focus most of my reading around: (1) history, (2) scripture, (3) fiction, and (4) what I’ll call professional context. Books that have to do with technology, economics, and business building in general.

So to keep things simple I’ll work to create space for each kind of reading and aim to read 10 pages per day per category. In the morning, 10 pages of history and 10 pages of scripture, throughout the day, 10 of professional context, and at night 10 of fiction. We’ll see what impact that has on upping my reading time but my main focus is broadening the surface area of ideas I’m exposed to.

I’m significantly more hesitant to set a specific goal for reading things like essays, white papers, and other shorter form writing. But I got exposed to an exceptional challenge from Ray Bradbury this year around this kind of reading. Here’s how he explains it:

“I’ll give you a program to follow every night. For the next thousand nights, before you go to bed read one short story, one poem, and one essay. One poem from the vast history of poetry; stay away from most modern poems, its crap. Read the great poets; Shakespeare, Alexander Pope, Robert Frost. And then a short story a night and an essay a night. From various fields; archeology, zoology, biology. All the great philosophers, comparing them. They’re crammed with pomegranate ideas. God, you’ll be full of stuff. Full of ideas and metaphors along with your own perceptions of life and your own personal experience. The more metaphors you can cram yourself with, they’ll bounce around inside your head and make new metaphors. That’s why you’re doing this.”

The combination of tracking my reading volume from books plus my attempt at tackling Bradbury’s reading challenge, that’s a massive top of funnel of ideas to more fully build out what Charlie Munger called a “latticework of knowledge.”

Research

“Research is to see what everybody else has seen, and think what nobody has thought.”

(Albert Szent-Gyorgi)

Across that top of funnel from reading, my focus isn’t direction. It’s breadth. A wide swath of ideas, stories, facts, mental models, and on and on. Research is engaging with the most important idea nuggets that come out of that breadth and attempting to “think what nobody has thought.” That framework comes from the quote above that Michael Dempsey exposed me to and has come to define how I think about research. I love it.

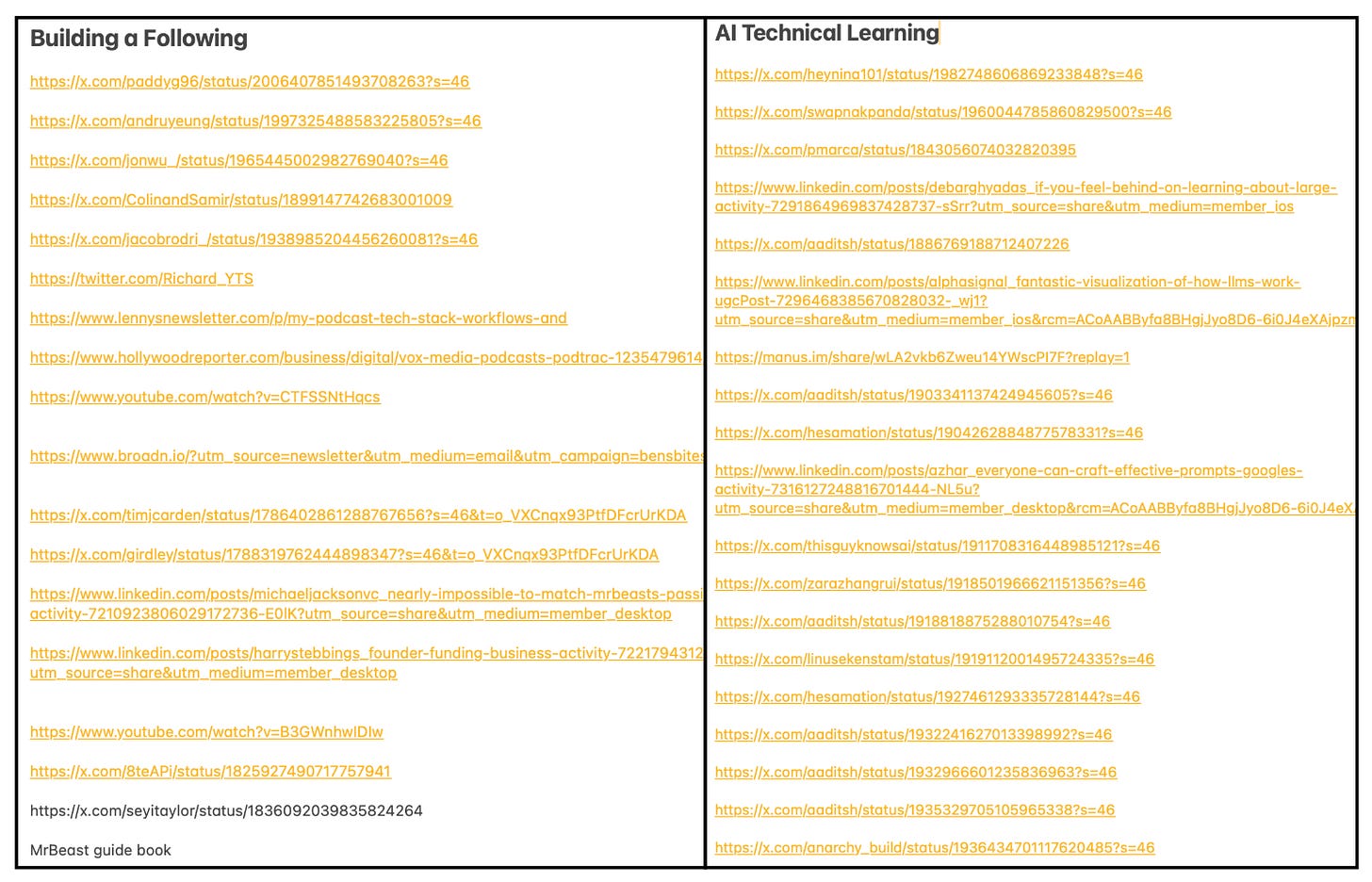

On the one hand, I have a topical collection of resources that I want to use to go deeper alongisde utilitarian outcomes. Everything from random courses that I’ve saved to going deep on more technical aspects of AI to things as simple as better building a following as distribution becomes more and more important.

On the other hand, I also want to keep my mind open to the ideas that I get exposed to, whether from my top-of-funnel reading or my broader Twitter addiction.

For me, the research process is all about going down the rabbit hole. But once I get down there, I have a series of outlets with different formats that I can use for research output. Contrary Research deep dives are one of them. My writing on this blog can be another (see below). So rather than having specific research goals, the act of reading on one end and writing on the other has research in the middle; but the writing output is more where my goals ended up focusing on.

Writing

I’ve written plenty about my particular style of panic writing. I usually reserve a few hours on Friday night or Saturday morning and do my best to write, churning out something worthwhile on a topic I’ve been thinking about. To be honest, 2025 was probably my weakest year in terms of consistently writing something I was proud of. I had a lot of weeks where I felt like I was putting something out just to avoid breaking my streak.

My hope this year is to more consistently produce meaningful writing that I’m proud of. Granted, I hesitate to say that I can just do what I’ve been doing with my weekly panic writing and expect different results. But there are a handful of efforts that I’m hoping will better concentrate my effort.

Micro Essays

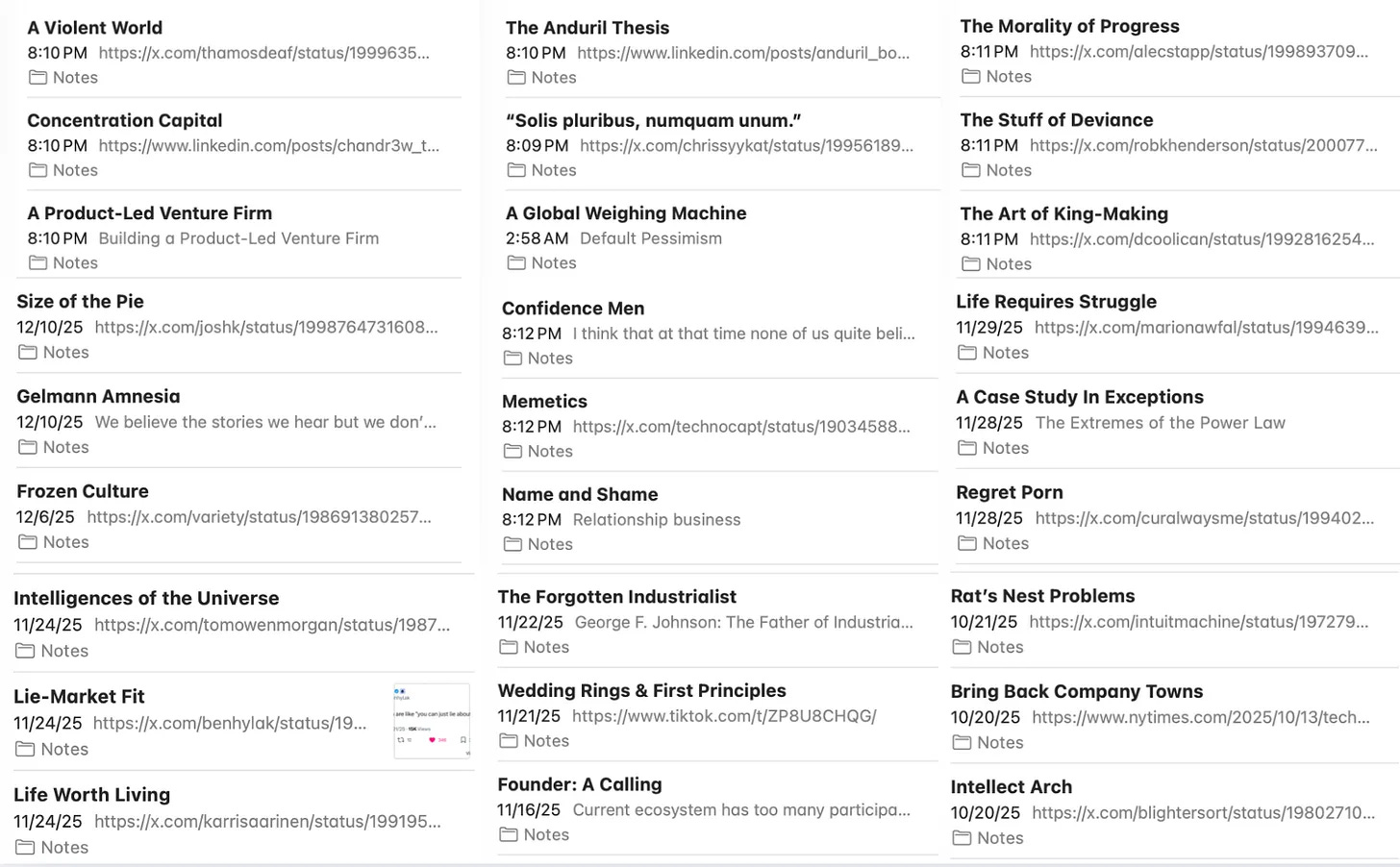

One of the things I’ve noticed is that I frequently have dozens of topics in my head that I frequently revisit in conversation.

Just a few examples?

Rat’s Nest Problems. This idea that any complex issue has a massive web of interconnected dependencies that make them feel unsolvable.

A Global Weighing Machine. The idea that, as hype becomes a palpable economic force, the power of the global weighing machine becomes less impactful.

Frozen Culture. People talk about how culture stopped progressing in the mid-2000s and has become obsessed with remakes, reboots, and sequels. Feels like that extends beyond pop culture into broader cultural areas.

My plan to push these deeper down the development pipeline is to start publishing micro essays. I was inspired by a bunch of these posts from Nikunj Kothari. His posts resonated because they’re punchy and impactful, capturing a core idea. My most significant delays in any of my writing is feeling the obligation to turn over every rock and dive into the research behind the core ideas. Micro essays will force me to capture the core idea and put it out into the world.

Sometimes, it will just be a micro essay version of my full piece in a given week. But more often, my focus will be on getting an idea out as soon as it develops. Give or take, once a week I’ll outline the core idea as best I can and get it out there without much polish.

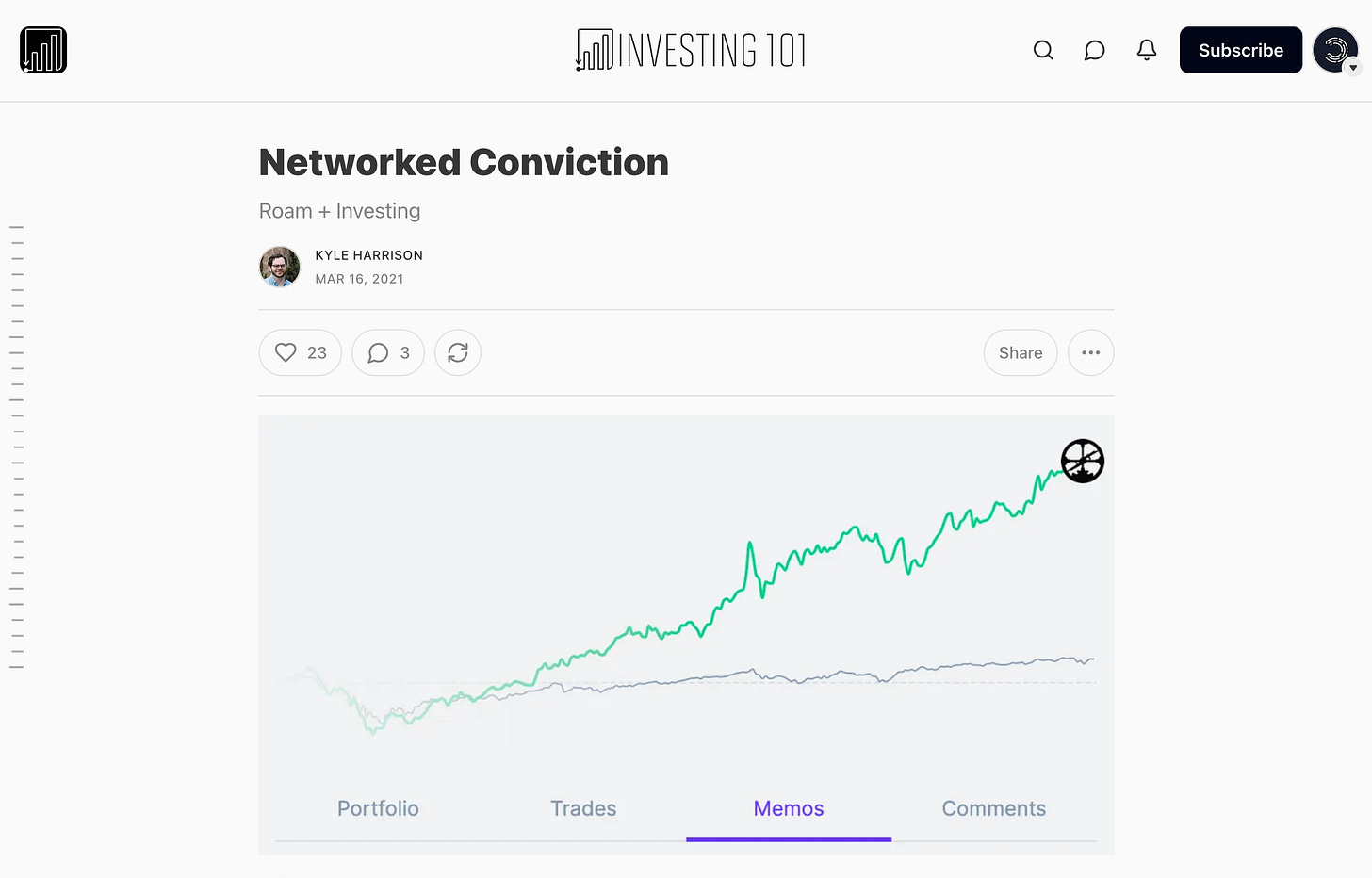

Networked Conviction: My Investing Journal

The blog post that it started it all! When I first created this Substack, it was to publish a piece back in 2021 where I unpacked my investment research process. Roam Research, as a tool, was a central part of the process. But really the critical element was unpacking how my ideas connected to each other. Hence the title; “networked conviction.” Since then, I’ve gotten a few requests for more detail around my research and investment process:

So I’ve decided to launch a new paid part of this Substack.

Networked Conviction: My Investing Journal

Now, I’ve never had any intention of making this Substack a paid offering nor do I want it to become a fundamental part of my income. Instead, my hope is that it becomes my second promise that motivates a part of my writing.

The first promise? Don’t miss a week.

The second promise? I’ll commit to sharing at least a weekly entry in my investing journal, Networked Conviction, if not more (depending on how much context I come across that week). For folks who pay for my Substack, the goal is to offer a deeper, more unfiltered cut of my thinking and research. Knowing that people are paying for it forces me to take it seriously.

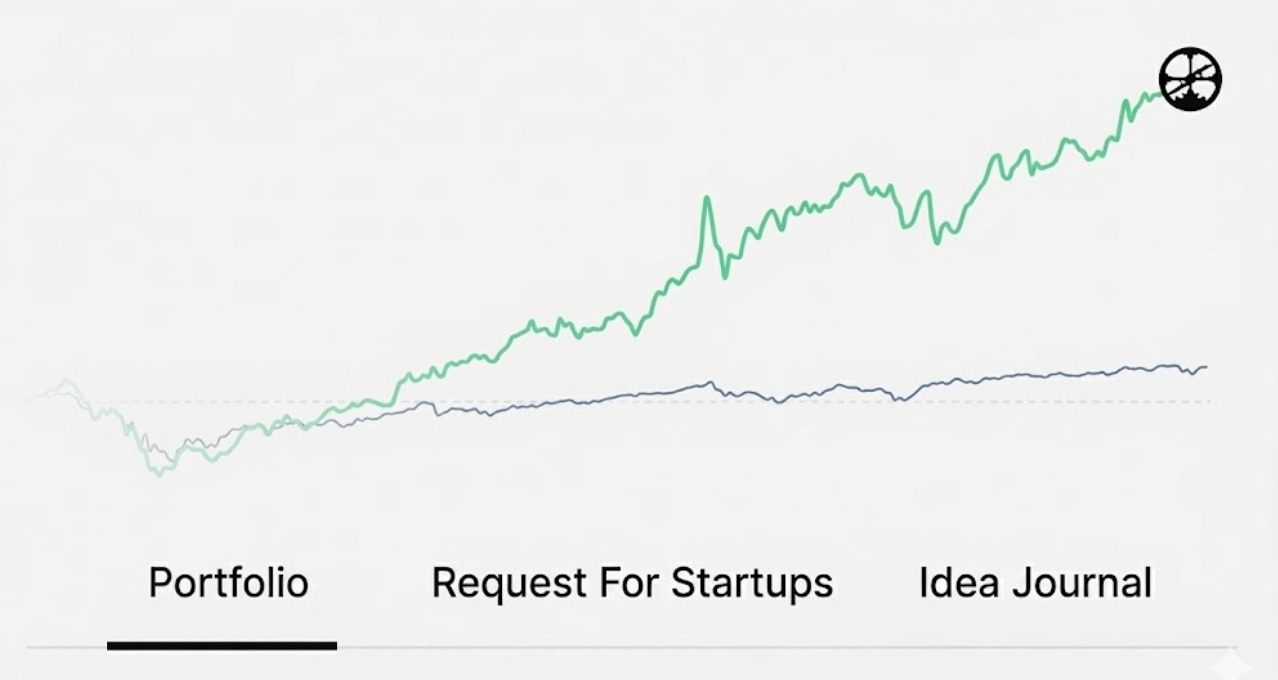

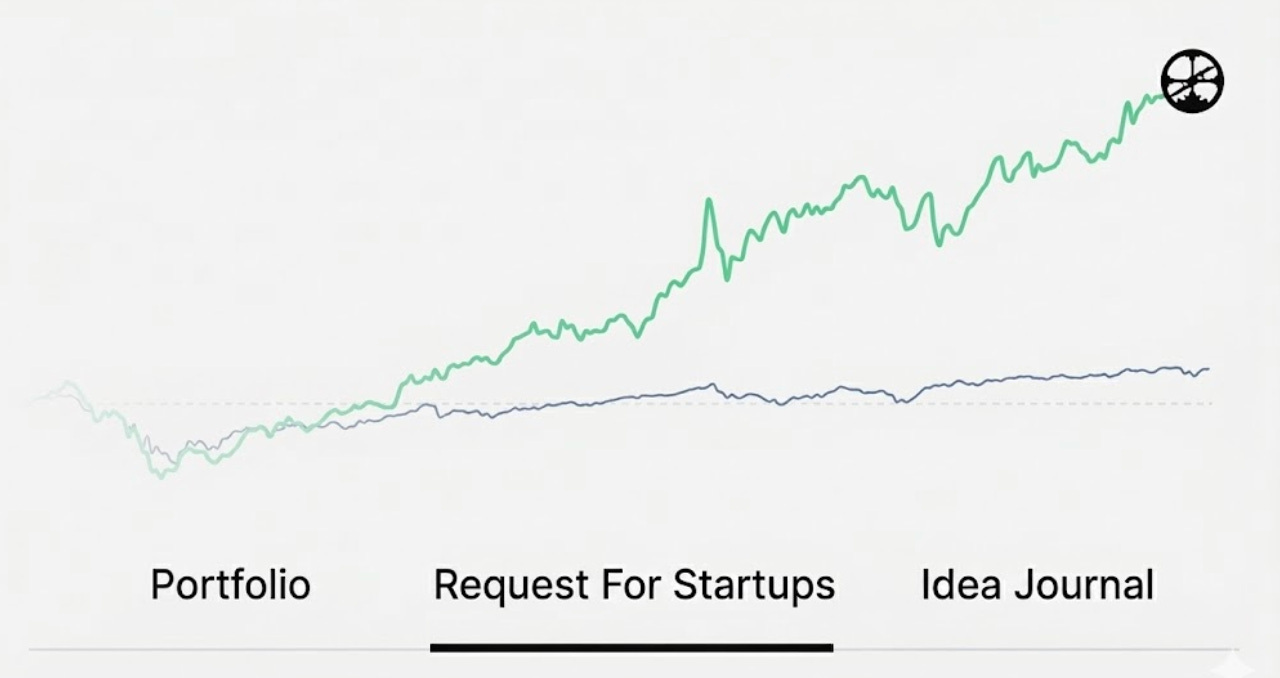

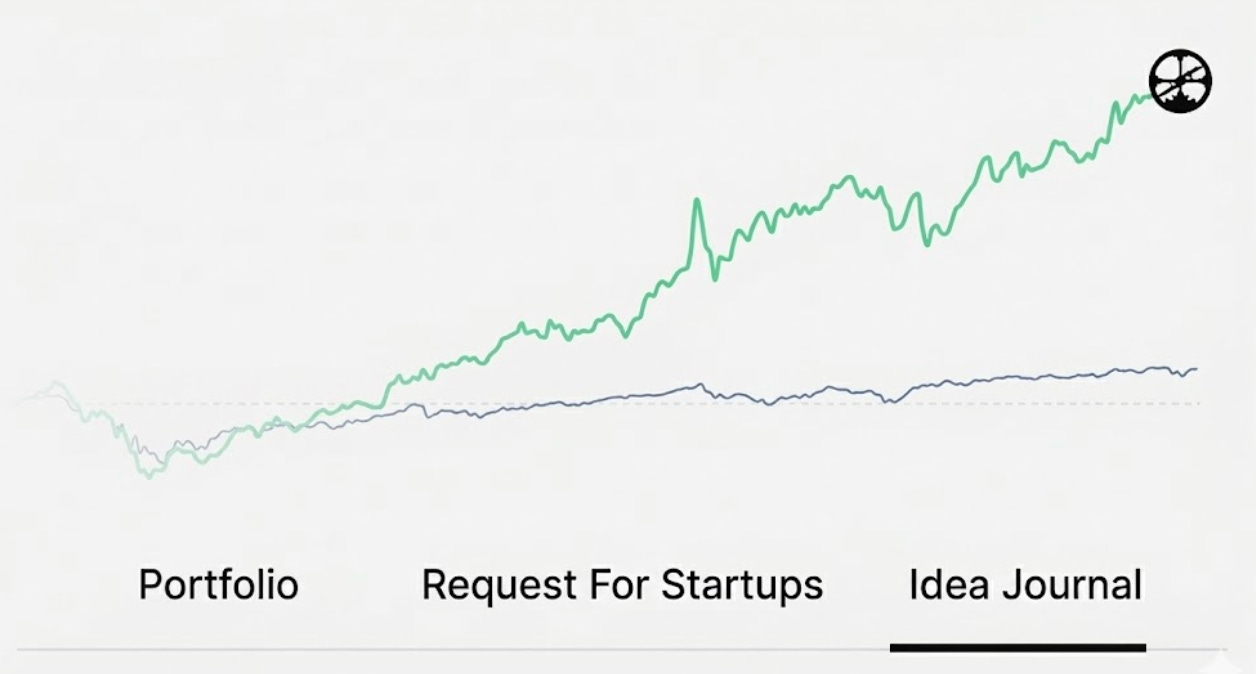

This may evolve over time, but my thinking is that entries in Networked Conviction will consist of one of three different types: (1) portfolio updates on the companies I’ve invested in, (2) my own version of Request For Startups, and (3) general investing ideas (frameworks, templates, etc.)

Portfolio

From nuclear energy to defense to robotics, a significant amount of my thinking revolves around the companies I invest in. So, first and foremost, my plan is to spend time reflecting on those companies as a lens to the ideas I’ve already gone deep on.

Request For Startups

I wrote a few weeks ago about the impact that YC’s Request For Startups had for me. So often, the reading and thinking and rabbit holing results in an directional idea of an opportunity that feels like it exists. So the plan is to use Networked Conviction as an outlet for sharing those as they develop.

Idea Journal

Finally, the Idea Journal is a catch all for frameworks, templates, mental models, market maps, advice, and any other investing-related ideas that resonated with me in a particular week. I see those artifacts as the nudges

If you’re interested in a paid subscription to Networked Conviction, check it out here.

Investing

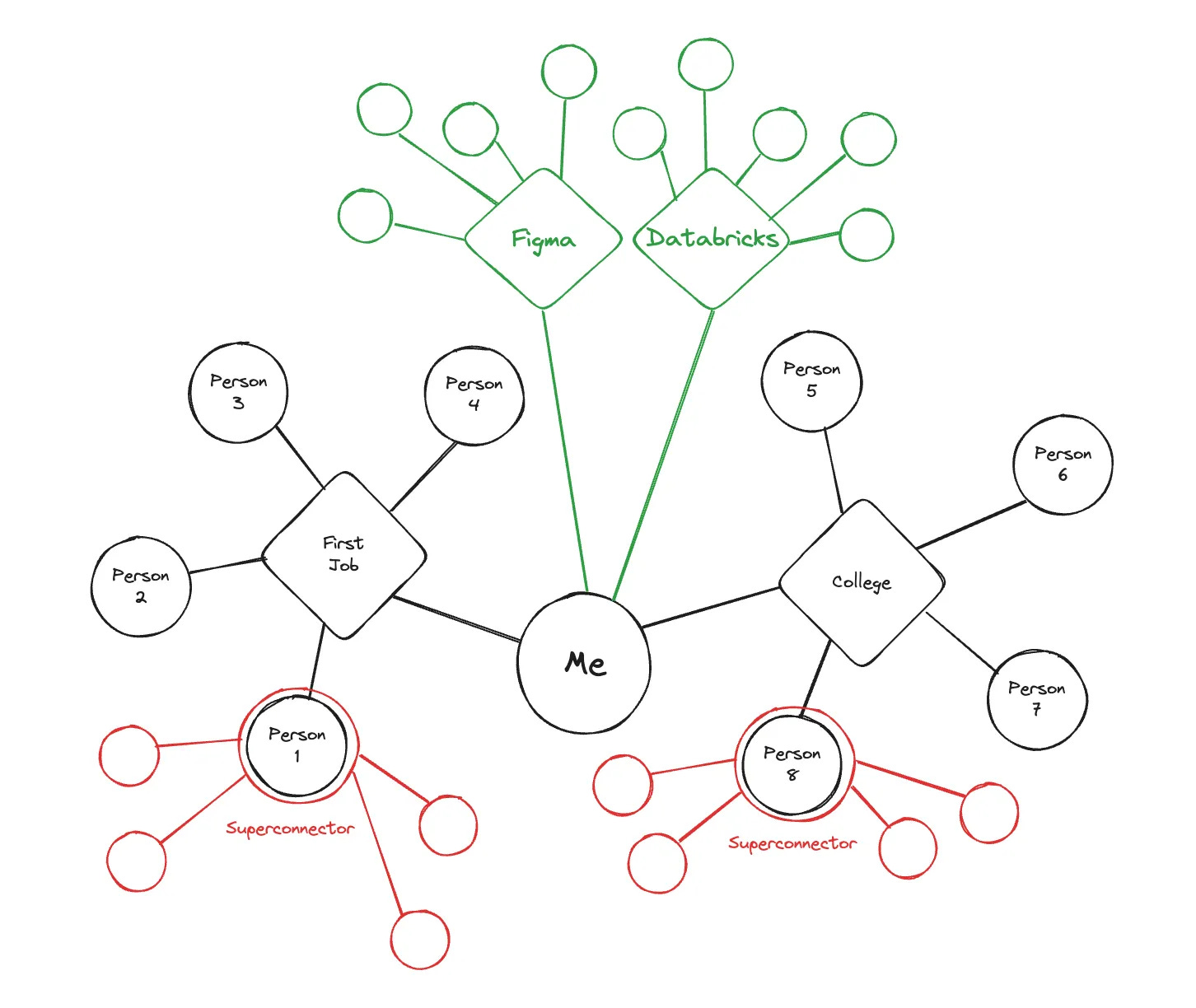

Finally, I wrote a piece a few months ago about how I would think about investing if I was getting started. One section, in particular, keeps coming back to mind: Building Nodes.

From unpacking core nodes of incredible people and into what I wrote about as “actual listening” in an effort to kick against the standard VC “how can I be helpful” meme. This is a big part of how VCs operate, but its something I want to more firmly tie that into my reading / researching / writing framework. How do I connect all the ideas rolling around in my head with all the people rolling around in my life?

I’m realizing now there is a theme. I’m leaning into the numbers game. In the same way that I want to try and read more, go down more rabbit holes, and write more, I also want to focus on increasing the volume of conversations I’m having on the investing side. The longer you’ve been a VC, the more it can feel comfortable to rest on your relationship laurels. You have a small group of people who frequently lead to new investment opportunities. But the best investors focus on constantly exposing themselves to new nodes.

A Daily Scorecard

To recap, my New Year’s goals around the compounding engine of my life for translating ideas into actions span across reading, research, writing, and investing:

Up The Reading Volume: 40 pages a day; 10 pages of history, 10 of scripture, 10 of professional context, and 10 of fiction.

The Ray Bradbury Reading Challenge: Before you go to bed, read one short story, one poem, and one essay.

Micro Essays As The Idea On Deck: Publish one micro essay each week where I try and get an idea out as soon as it develops, rather than languish in pursuit of turning over every leaf.

Networked Conviction: Launch the paid section of this blog with an investing journal that includes portfolio updates, my own Request For Startups, and an idea journal as a catch all.

Let’s see how the year goes!

Thanks for reading! To receive Networked Conviction: My Investing Journal, a collection of portfolio updates, Requests for Startups, and investing ideas for paid subscribers, you can sign up below:

Love how the 40 pages/day framework breaks down into 4 distinct categories instead of just lumping everything together. The Bradbury challenge though is the real gem here, especially the part about metaphors bouncing around creating new metaphors. I've found that this kind of cross-domain reading actaully speeds up pattern recognition in unexpected ways, like when a history book suddenly illuminates a tech trend better than any whitepaper could. The micro essay approach makes a lot of sense too, most breakthrough thinking starts as half-baked ideas anyway.

Love this compounding engine framework. Wonder how you might measure whether founders in your portfolio who apply that same numbers game approach internally (more experiments, more user feedback, more assumption testing) might outperform the more deliberative/selective ones. Do you think this thesis extends from how to invest to how to build a startup especially in the early idea stages?